- The Roundup

- Posts

- $380 Billion Won't Fix a $38 Trillion Problem (But Bitcoin Will)

$380 Billion Won't Fix a $38 Trillion Problem (But Bitcoin Will)

💸Government stimulus checks, privacy coin mania, and why Bitcoin's technical support matters more than ever

Welcome everyone to the latest edition of The Roundup.

This week on our radar, we're covering the following 👇

Trump's $2,000 stimulus math just doesn't add up…

Zcash's parabolic rally and the warning signs every Bitcoiner should recognize

Bitcoin holds critical bull market support at $103K as volatility shakes out weak hands

Let’s get into it!

1️⃣ Trump's Stimulus Math: Rearranging Deck Chairs on the Titanic

President Trump announced this week that he's considering granting $2,000 stimulus checks for every American (excluding high-income earners) funded by tariff revenue. Let's run the numbers.

High-income earners constitute roughly 20% of the U.S. total population of 340 million people. Add to that number both children (representing ~74 million individuals) and non filers (another ~10 million people). That leaves ~188 million Americans eligible for the $2,000 stimulus check.

Simple math: 188 million people × $2,000 = $376 billion.

Trump posted on Truth Social: "All money left over from the $2,000 payments made to low and middle income USA Citizens… will be used to SUBSTANTIALLY PAY DOWN NATIONAL DEBT."

Here's the problem: there IS no money left over.

The U.S. has only collected about $217 billion in tariff revenue so far in 2025. Even optimistic projections put total tariff revenue at around $300 billion for the full year.

Do the math:

Tariff revenue collected: $217 billion (or $300 billion optimistically)

Cost of stimulus checks: $376 billion

Money "left over" to pay down debt: Negative $159 billion

Trump is promising to pay down the $38 trillion national debt with money that doesn't exist. The checks alone would require printing an additional $159 billion beyond what the tariffs actually generated in 2025.

This isn't stimulus. It's political theater with monetary debasement. Every dollar created to fund these checks dilutes the purchasing power of every dollar you already own.

We're nowhere close to fixing the debt problem, and Bitcoin remains the only long-term solution to opt out of this mess.

📊 Trump's $2,000 stimulus checks - what actually happens? |

2️⃣ Zcash: When Parabolic Pumps Become Painful Lessons

Bitcoiners have been talking about Zcash (ZEC) this week. The privacy-focused cryptocurrency exploded from $50 to over $700 in less than three months, rallying more than 12x since mid-September.

With a market cap now exceeding $10 billion, Zcash is getting attention as "Bitcoin with privacy features".

But before you FOMO in, let's look back at the history of Zcash’s previous price action rallies.

Rally #1: Apr 2017 - Jan 2018 where ZEC pumped 12x from ~$70 to $850+. Then it crashed back to double digits.

Rally #2: Nov - May 2021 where ZEC rallied 6x from ~$50 to $300+. Then it bled back down to $50 by 2024.

Rally #3: Sep 2025 - Nov 2025 where ZEC rallied 14x ~$50 to $700+.

Source: Coingecko

See the pattern? Each rally gets hyped as ‘the privacy narrative finally taking hold’. Each rally attracts retail traders who missed Bitcoin. And each rally ends with Zcash bleeding back to reality while BTC grinds higher.

Even after this 12x rally, Zcash is still down 82% from its all-time high of $3,191 set back in October of 2016. If you bought the top of any previous cycle, you're still underwater nearly a decade later.

This recent rally has all the hallmarks of a narrative trade:

Parabolic price action with a narrative that’s "different this time"

Retail euphoria with every influencer on X suddenly becoming a privacy expert

A historical track record of pumping hard and then dumping harder

Unless you're a profitable momentum trader setting tight stop losses, you're not trading, but rather gambling. And the house (early insiders who accumulated at prices around $50) always wins when retail shows up late to the game.

Bitcoin has a 15-year track record of going up and to the right. No founder to dump on you. No pattern of pumping 10x and bleeding 90%. Ask yourself the question - are you chasing the top, or building generational wealth?

3️⃣ Bitcoin Defends Bull Market Support (Volatility Is a Feature, Not a Bug)

Bitcoin shook out weak hands this week, briefly dipping below $100,000 before bouncing back above its 50-week exponential moving average at approximately $103,000. The bull market remains intact.

The 50-week EMA has been Bitcoin's line in the sand since early 2023. Historically, every close below this level preceded a bear market. Every hold above it preceded massive rallies. This isn't tea leaf reading (it's happened three times across 2013, 2017, and 2021).

As Hector Alvero breaks down in his video this week, Bitcoin's volatility isn't a flaw, but a feature. Check it out below👇

The key takeaway? Bitcoin's 20% drawdowns are the cost of participating in the hardest money ever created. The volatility is the price you pay for an asset that can't be debased, diluted, or controlled by any government.

With Trump's stimulus checks likely injecting more liquidity and the 40-day government shutdown finally nearing resolution, Bitcoin is positioned to benefit. The technical support held. The fundamentals remain unchanged. The bull market is still very much alive.

🎯 The Final Word

Trump's $2,000 checks won't fix a $38 trillion debt problem - they’ll merely accelerate the debasement trade. There's not even enough tariff revenue to pay for the checks, let alone pay down debt.

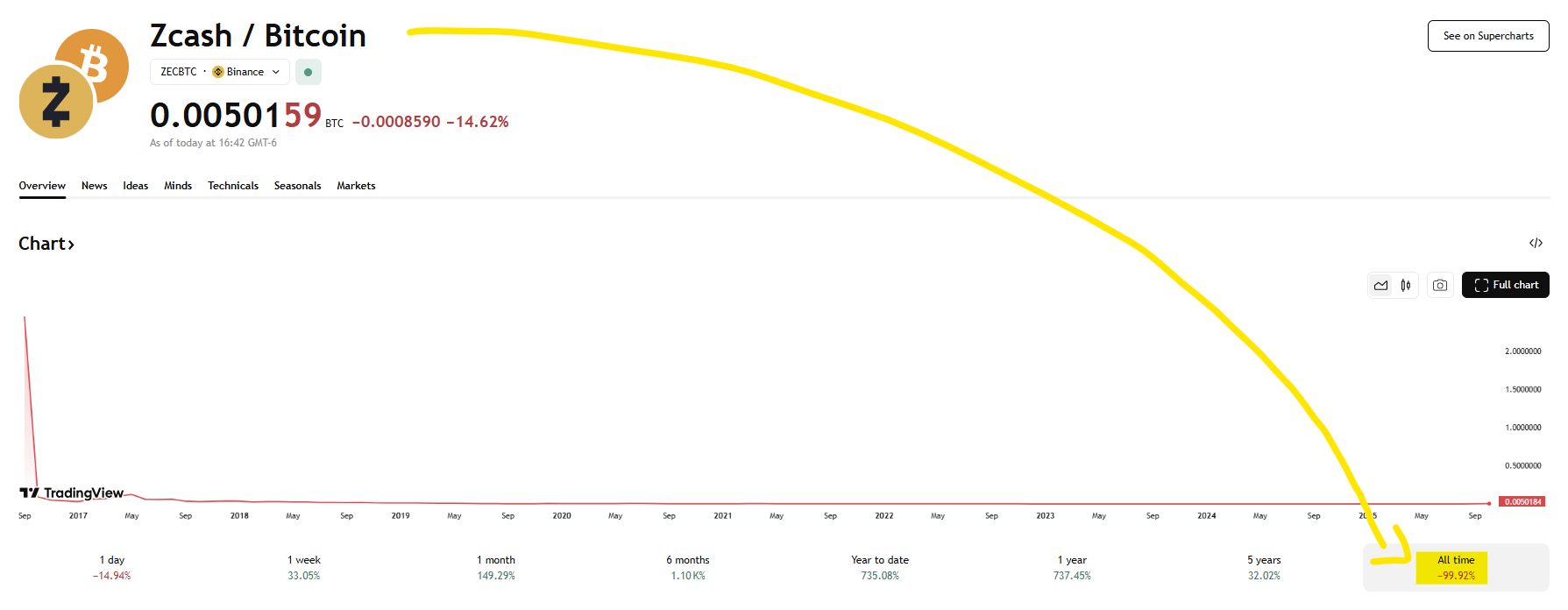

Zcash's 12x rally looks impressive until you realize it's still down 99.92% from its peak when priced in Bitcoin.

Source: TradingView

And while weak hands got shaken out this week, Bitcoin defended critical support at $103K.

The money printer isn't stopping. Narratives will fade, but Bitcoin doesn’t. The only question isn't whether the system will keep printing. It's whether you'll still be holding depreciating dollars when it does.

Chat next week,

The Rhino Bitcoin Team

P.S. Zcash rallied more than 10x in the last few months and it's still down 99.9% in Bitcoin terms (it peaked at 4.43 BTC per ZEC back in October 2016).

Start measuring your wealth in Bitcoin (instead of ZEC) today with industry-low fees on Rhino available here (for iOS) or here (for Android).

⚡Lightning Round

Quantum Computing Threat Debunked: Bitcoin's cryptography remains secure against current quantum capabilities.

JPMorgan Increases Bitcoin ETF Holdings by 64%: Banking giant boosts BlackRock's IBIT position to $343 million.

Shutdown Nears End After 40 Days: Senate advances deal to reopen government after longest shutdown in U.S. history.