- The Roundup

- Posts

- CZ Walks Free: What Comes Next?

CZ Walks Free: What Comes Next?

😲 Gold stalls at 50-year highs while centralized systems collapse on multiple fronts

Welcome everyone to The Roundup!

This week on our radar, we’re covering:

CZ's pardon is proof of regulatory shake up.

Gold rally stalls at technical extremes while Bitcoin waits in the wings.

Centralized failures pile up as AWS and the federal government both collapse.

Let's get to it!

1️⃣ CZ Walks Free: The Regulatory Reset Continues

On October 24th, President Trump pardoned Changpeng Zhao, ending the Binance founder's sentence for Bank Secrecy Act violations. So, what implications does this have on the digital asset industry?

First, the regulatory winds have shifted. Between the incoming crypto-friendly Fed chair replacing Powell next year (with Trump stating the decision might come as soon as year end ‘25), favorable legislation in Congress, and now CZ's pardon, the U.S. is sending an unmistakable message: we're open for business.

Source: Justice.Gov

Second, this could mark the beginning of yet another speculative cycle. History shows regulatory leniency often precedes market excess.

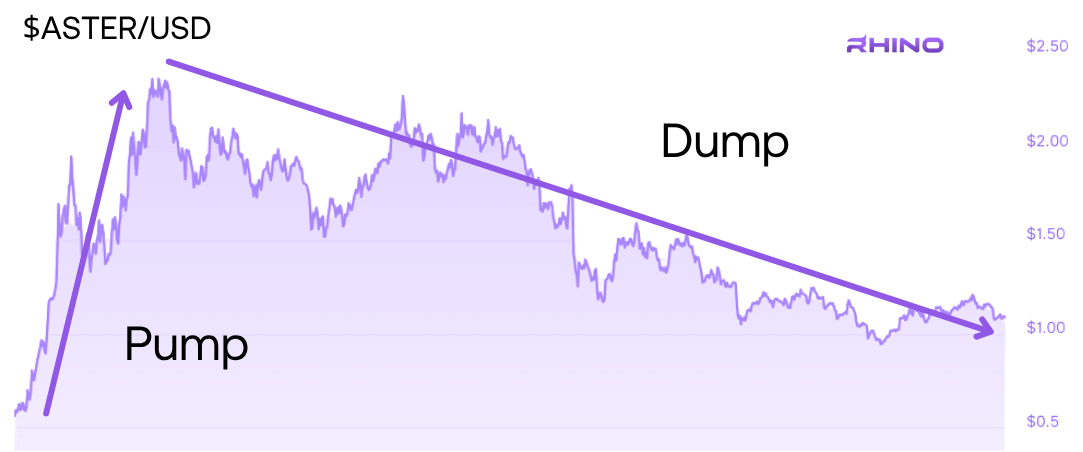

Consider Aster, CZ's newly launched DEX. The token pumped from 58c to $2.22 initially, subsequently bledding back to $1.09 - down more than 50% in just weeks. Early investors with access to CZ's network secured cheap positions, then systematically exited into retail enthusiasm.

Source: CoinGecko

One thing to keep in mind - Bitcoin is fundamentally different. It's the only digital asset with a proven 15-year track record that doesn't bleed out. No founder dumping. No insider allocations. Just pure supply and demand on the hardest money ever created.

CZ's pardon may be positive for regulatory clarity, setting the stage for the next “crypto” rally but it doesn't change this reality.

2️⃣ Gold Rally Stalls at 50-Year RSI High (Bitcoin's Turn Next?)

Gold bugs have been smug lately, and they've earned it. Gold crushed new all-time highs this month.

But they’re missing one key ingredient - gold fails as money in a digital economy. It isn't digitally native, can't be programmed, and requires trusted third parties. It's a 5,000-year-old analog solution struggling to stay relevant.

Furthermore, the gold rally appears exhausted, with Gold's monthly RSI just hit a 50-year high (a level that historically precedes strong short term corrections). Analysts expect a pullback toward $4,100.

We touched on this last week, but here's where it gets interesting.

Historically, gold front-runs liquidity cycles by 188 days (~3 months). Bitcoin follows once that liquidity hits the system. Gold has broken out while the government shutdown slows liquidity (temporarily). Meanwhile, China's central bank is quietly ramping up liquidity injections.

These are early signals of a global liquidity turn. While crypto Twitter panics, macro fundamentals paint a different picture. Gold's breakout might be the most bullish leading indicator for Bitcoin's next leg higher (the below chart from Real Vision shows this correlation more clearly).

Source: Real Vision

The irony? Boomers celebrating gold may have given Bitcoiners the clearest buy signal available 😂.

3️⃣ Centralized Systems Fail on Multiple Fronts

This week also showed precisely why decentralization isn't philosophical - it's practical necessity.

Amazon Web Services experienced a catastrophic outage. Banking apps failed. Streaming services went dark. E-commerce froze. For hours, the digital infrastructure billions depend on simply stopped.

As @HectorAlvero explains in this week's video, we've all built our digital lives around these centralized giants. You don't own your digital life - you rent it from Microsoft, Google, and Amazon.

But AWS wasn't the only centralized failure - just the most visible.

The U.S. government shutdown is now the second-longest in history, approaching a full month. Airport delays mounting. Federal services shuttered. Lawmakers no closer to agreement.

Within the same week, the world's largest economy and its most critical cloud infrastructure both failed. These aren't isolated incidents - they're symptoms of over-centralization.

Bitcoin was designed for moments like these. No single server to crash. No political deadlock. Just a distributed network running 24/7/365, settling transactions without permission from anyone.

🎯 The Final Word

This week showed us the great regulatory reset in real-time. CZ's pardon confirms the U.S. is open for crypto business, though it raises questions about another speculative wave. Gold's rally is stalling at 50-year extremes, potentially setting up Bitcoin's next move as liquidity turns. And centralized systems - from AWS to the federal government - reminded us why decentralization is necessity, not rhetoric.

The sophisticated money is monitoring these signals. Regulatory clarity is improving. Macro is shifting in Bitcoin's favor. And Bitcoin keeps running with perfect uptime while centralized alternatives buckle.

In a world where centralized systems fail and fiat debasement accelerates, you either position in scarce, decentralized assets now or watch your purchasing power erode. The infrastructure is crumbling. The liquidity is turning. And Bitcoin kept working flawlessly through it all.

The question isn't whether you should be positioned. It's whether you can afford not to be.

Chat next week,

The Rhino Bitcoin Team

P.S. While CZ celebrates his pardon and new altcoins pump on pure hype, Bitcoin just keeps producing blocks every 10 minutes with mathematical precision.

⚡Lightning Round

Eric Trump's American Bitcoin Buys Another 1,000 BTC: Company increases strategic reserve to 3,865 Bitcoin.

Citi Initiates MSTR Coverage with $485 Target: Banking giant launches coverage, calls MicroStrategy "strategy bellwether" for BTC exposure.

Tucker Carlson Refuses Bitcoin, Claims "CIA Operation": Conservative commentator rejects Bitcoin, claims it enables "totalitarian control".