- The Roundup

- Posts

- Is the Bull Run Over?

Is the Bull Run Over?

❓ Bitcoin breaks through key resistance levels as the continued bull run is called into question

Welcome everyone to the latest edition of The Roundup.

This week on our radar, we're covering the following 👇

Market fear reaches extreme levels (is the top in?).

Europe's digital euro accelerates the war on citizen’s privacy.

MicroStrategy gets its first credit rating (spoiler: it's "junk" status) 😂

Time to dive on in!

1️⃣ The Market Is Fearful – But Should You Be?

Fear is gripping markets across the board. Bitcoin failed to hold its critical $108,000 technical level, dropping nearly 8% from recent local highs. The Fear & Greed Index for the S&P 500 has also shifted back to "fearful" territory, despite equities sitting just 1% from their all-time highs (what gives?).

The Bitcoin crowd is now asking the uncomfortable question: Has Bitcoin been left in the dust, or is this another classic shakeout before the next leg higher?

Well, lets look at the current landscape:

First, sentiment appears to have reached capitulation levels. “Crypto” market sentiment just hit its most negative reading since April ‘25. Although its a rather crude indicator, historically, when this metric turns orange or red, it has identified local price bottoms with over 90% accuracy. Translation: maximum fear equals maximum opportunity.

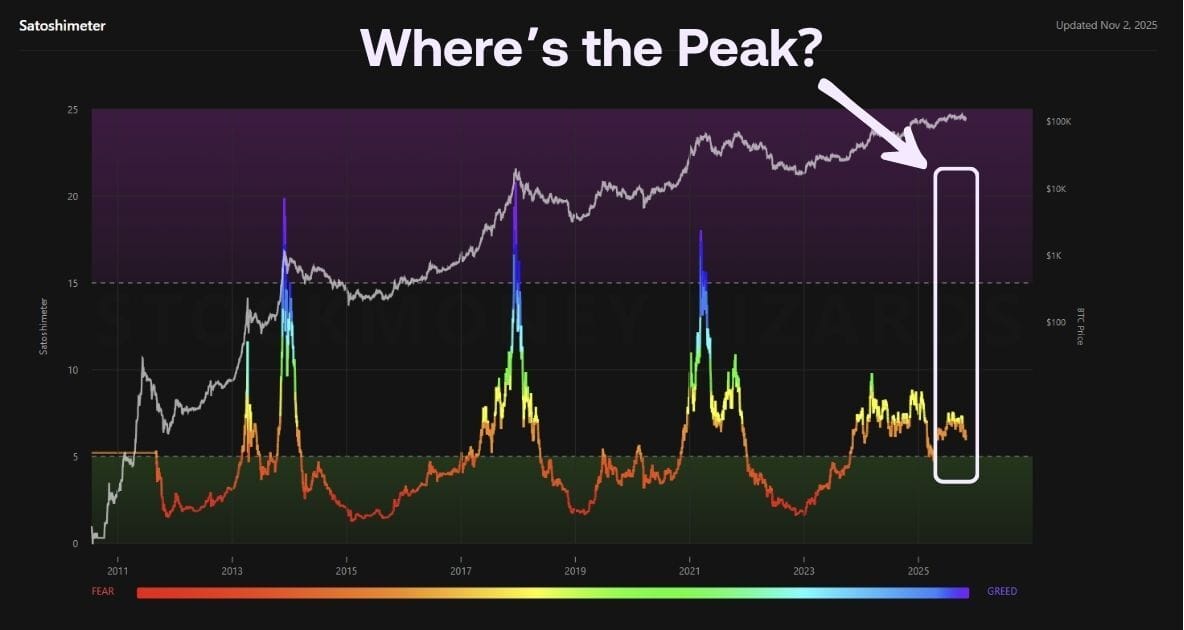

A more useful metric however, is the below data point which further invalidates the thesis of us reaching a local cycle top. The “Satoshimeter” currently reads around 6, nowhere near the extreme greed levels of 17-20 that marked prior cycle peaks in 2013, 2017, and 2021 (see white arrow below).

As @StockmoneyL points out, "we are nowhere near the top... If history rhymes, the final leg of this bull run likely plays out many months into 2026".

Source: @StockmoneyL

Thirdly, November has been Bitcoin's strongest performing month historically, averaging over 40% returns since 2013 (42.3% to be precise). Now, we all know that past performance doesn't guarantee future results, however seasonal strength combined with oversold conditions does create a rather compelling risk-adjusted buy setup.

Warren Buffett's famous axiom applies perfectly here: "Be fearful when others are greedy, and greedy when others are fearful." With fear dominating the financial news headlines while fundamentals remain fully intact, contrarian positioning looks increasingly attractive at these levels.

2️⃣ Europe's Digital Euro: The Quiet War on Financial Privacy

ECB President Christine Lagarde just accelerated the timeline for Europe's central bank digital currency. The pilot launches in 2027, pending European Parliament approval in 2026, with full rollout targeted for 2029.

But let's call this out for what it truly is: a systemic assault on financial privacy disguised as technological innovation (watch below as Christine Lagarde does a masterful job of manipulating this announcement into a ‘benefit’ for European citizens’ digital freedom).

The digital euro would complement banknotes and extend the benefits of cash to the digital sphere. This is important because euro cash brings us together.

Europeans would have the freedom to use the digital euro for any digital payment, online or offline, throughout the euro

— European Central Bank (@ecb)

11:01 AM • Oct 31, 2025

So, what’s the key takeaway from this? Well, governments are finally saying the quiet part out loud. Cash is being phased out, replaced by programmable money that tracks every transaction, monitors every purchase, and enables instant account freezes at the push of a button.

The "Digital Euro" sounds harmless enough to voters, but make no mistake, this is a Central Bank Digital Currency (CBDC) designed for total financial surveillance.

And Europe is scrambling to catch up. Stablecoin volume is exploding across Latin America and the United States, processing trillions in transaction volume. Meanwhile, Europe watches from the sidelines, unable to compete with permissionless innovation. Their solution? Force adoption through regulatory capture.

The implications are that every coffee purchase will be tracked. Every political or charitable donation monitored. Every transaction subject to approval.

The Digital Euro isn't about modernizing payments, it's about cementing control over how citizens can spend their own money.

This is precisely why Bitcoin matters. While Europe builds its financial panopticon, Bitcoin offers the opposite: permissionless transactions, censorship resistance, and genuine financial sovereignty. The contrast between the two ideological principles couldn’t be starker.

What's your take on CBDC's?Do they represent a threat to citizens financial privacy? |

3️⃣ MicroStrategy's "Junk" Rating Proves We're Still Early

MicroStrategy just achieved a major milestone in the Bitcoin Treasury Company world - they became the first Bitcoin-focused corporation to officially receive a credit rating.

So what rating did they get? Moody's slapped them with a “B-” score which is deep in junk territory and far from the much desired “Investment Grade” status many firms strive for. Remember, an investment grade rating is perceived as lower risk, thus opening up the door to large institutional capital allocators.

Source: Corporate Finance Institute

As Hector Alvero explains in this week's video, this "junk" designation actually proves how early we still are in Bitcoin's institutional adoption cycle:

A major milestone for the Bitcoin Treasury Company thesis: MSTR just became the first to receive a credit rating.

Our COO, @HectorAlvero, explains why its “junk status” rating proves how early we still are, despite banks and nations adopting Bitcoin as a strategic reserve.

— Rhino Bitcoin App (@RhinoBitcoin)

2:02 PM • Oct 31, 2025

Think about it: MicroStrategy holds over 400,000 BTC worth ~$40 billion, representing one of the largest corporate treasuries on Earth. Their Bitcoin holdings dwarf the cash reserves of most S&P 500 companies. Yet rating agencies still classify them as high-risk because they don't understand Bitcoin's role as pristine collateral.

The irony is wild. While Moody's rates MicroStrategy as “junk status”, sovereign nations are establishing Bitcoin strategic reserves. While credit agencies warn of volatility risk, numerous corporations are replicating Saylor's playbook.

The disconnect between traditional finance's assessment and the market’s reality has never been wider.

This rating is likely to age as well as Blockbuster dismissing Netflix. When Bitcoin becomes the global reserve asset, today's "junk" rating will be tomorrow's punchline. Rating agencies are using 20th-century metrics to evaluate 21st-century innovation.

🎯 The Final Word

Fear is gripping markets. Yes, Bitcoin broke key support. Yes, sentiment hit multi-month lows. Yes, MicroStrategy got slapped with a "junk" credit rating.

But none of this changes Bitcoin's fundamental thesis. If anything, Europe's digital euro proves the case stronger than ever. The more governments push CBDCs and financial surveillance, the more obvious Bitcoin's value as permissionless, peer-to-peer money becomes.

The data tells the real story: we're nowhere near cycle tops, and November historically delivers +40% average returns for Bitcoin.

Fear in markets, surveillance in money, confusion in ratings - all symptoms of the old system failing while Bitcoin keeps producing blocks every 10 minutes.

The choice remains binary: programmable surveillance money or programmable freedom money. Fear today, or purchasing power tomorrow.

Chat next week,

The Rhino Bitcoin Team

P.S. Don't be the only one ignoring Buffett's advice. Be greedy when others are fearful and start your Bitcoin journey today with industry-low fees here (for iOS) or here (for Android).

⚡Lightning Round

Tether Holds More Treasuries Than Nations: Stablecoin issuer is now the 17th largest US debt holder globally, surpassing South Korea, UAE, and Germany.

France Targets Unrealized Crypto Gains: New tax bill expands to include unrealized digital asset gains while planning 420,000 BTC reserve.

Nvidia Outperforms Bitcoin: AI chip giant delivers higher 5-year returns than Bitcoin, highlighting tech stock competition.