- The Roundup

- Posts

- The Capital Stack: A Game of Musical Chairs

The Capital Stack: A Game of Musical Chairs

When the music stops, equity holders are left standing

Good morning Bitcoiners, Hector here with the Roundup.

Whale-sized orders just returned to Bitcoin at the $86K mark (the first green dot on the chart in weeks).

A treasury company borrowed $210 million and is now facing delisting.

And while everyone watches price, one key Bitcoin metric quietly hit an all-time high.

1. The Capital Stack Reality Check

Nakamoto Holdings just borrowed $210 million USDT from Kraken at 8% interest, collateralized by 150% in Bitcoin.

The stock? Down 98% from its May peak and now facing Nasdaq delisting.

On Dec 10th, Nasdaq issued a notice after NAKA traded below $1 for 30 consecutive days. The company has until June 2026 to get back above a dollar - or face delisting.

So what’s the backstory? Well, after merging with Kindly MD back in May earlier this year, the stock surged to $25. Then $563 million in PIPE financing came due. Those discounted shares flooded the market in September, and the stock collapsed.

Now Kraken sits safely at the top of the capital stack. If Nakamoto can't repay the $210 million loan, Kraken takes the Bitcoin. Meanwhile, equity shareholders (now more aptly described as “bagholders”) sit at the bottom of the capital stack, absorbing the full weight of the unwind.

As Justin Bechlar put it: "Kraken effectively bought the scraps of Nakamoto for pennies on the dollar".

This is the Bitcoin capital stack in action.

When you buy equity in a Bitcoin treasury company, you're not buying Bitcoin. You're buying the residual claim after everyone else gets paid - the PIPE investors, the lenders, the preferred shareholders.

The lesson isn't that treasury companies are scams. The lesson is that owning Bitcoin directly means you own the asset, not a derivative of someone else's balance sheet.

No lenders ahead of you. No PIPE deals diluting you. No delisting risk.

When volatility hits, simplicity wins.

Skip the complex capital stack and own Bitcoin directly. Rhino makes stacking on autopilot simple so set up your own auto-stack.

2. Lightning's Quiet Breakout

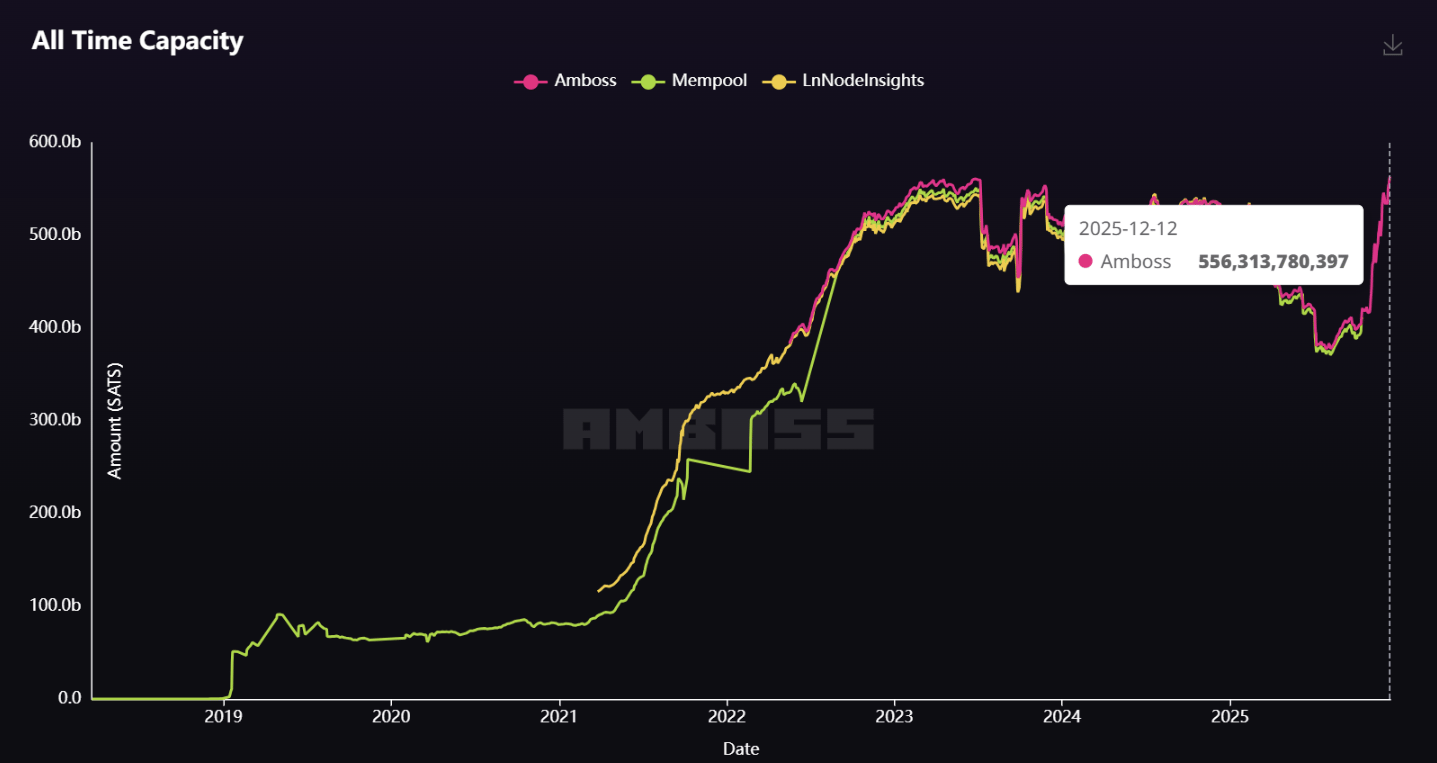

Everyone's watching price (as usual). Almost nobody noticed Lightning Network bitcoin capacity just hit an all-time high (pink line below).

And it's not just one whale moving the needle.

According to Amboss, companies across the ecosystem are adding capacity to Lightning - Binance, Block, OKX, and LNBIG all showing significant capacity increases since October.

This also only counts public channels (as private channel capacity isn't tracked), meaning actual Lightning usage could be even higher.

This matters for a few reasons.

First, it's infrastructure. Lightning is how Bitcoin scales for everyday payments. More capacity means more potential throughput.

Second, it's conviction. Companies don't add liquidity to a network they think is dying. They add it when they expect demand to grow.

Third, it's yield. Running a Lightning node can generate returns through routing fees. As payment volume increases, so does the potential for real, non-inflationary yield on Bitcoin.

The price might be choppy, but the plumbing is finally beginning to scale. When stronger demand returns, the infrastructure will be ready.

3. The First Green Dot (of Many?)

CryptoQuant tracks average order sizes across major exchanges to identify who's driving the market (i.e. whales or retail).

The pattern is predictable. When prices start falling, whales sell first (green dots at the top). Then retail panics and sells at the bottom (red dots). Eventually, whales start buying again (green dots return), and prices normalize (grey dots).

On Sunday, the first green dot appeared at $86,000 - meaning whale-sized orders are back at these levels.

One dot doesn't make a trend. But historically, green dots appearing after a sea of red signals that large buyers are stepping back in.

Meanwhile, Glassnode data shows whales have been accumulating throughout the drawdown. Large holders aren't selling into weakness. They're buying it.

This is the pattern that precedes reversals: retail exhausts itself selling, whales absorb the supply, and eventually there's no one left to sell.

We're not calling a bottom. But the data suggests the panic phase may be ending.

Is this the bottom for Bitcoin's price? |

The Final Word

Nakamoto's 98% drawdown while lenders sit protected at the top of the stack isn't an anomaly. It's how capital structures work.

Owning the asset directly means you're not exposed to someone else's leverage, their funding costs, or their liquidation risk. You own Bitcoin. That's it.

Meanwhile, Lightning capacity is quietly hitting all-time highs as real companies build real infrastructure. And the first signs of retail exhaustion are appearing on chain.

The price may chop. The builders keep building. And the simplest strategy remains the most resilient.

Own the asset. Not the wrapper.

Chat next week,

- Hector

P.S. Do you use the lightning network on a daily basis? If you answered “no”, why not? Let us know and we’ll give the best response 2,100 sats and a shout out on Twitter.

How could we improve? |