- The Roundup

- Posts

- The Cycle is Dead. Long Live the Cycle.

The Cycle is Dead. Long Live the Cycle.

❓What actually drives Bitcoin's price - and why the answer keeps changing

The 4-year cycle is dead. The 4-year cycle is not dead. The 4-year cycle is dead. Round and round we go.

This week, Fred Kruegar claimed that believing in cycles is "the most important financial decision of your life", all the while another prominent Bitcoin analyst tells us to forget the halvings altogether.

Not sure which it is? Lucky for you prediction markets are everywhere and are now being sold to you as "crowd intelligence" (when in reality they're just gambling with better PR).

This week on the Roundup, we unpack each of these narratives.

1. The 4-Year Cycle: Fact or Folklore?

Fred Krueger racked up almost 50 thousand views with this take👇

The most important financial decision of your life? Really?

More important than your savings rate? Your career? Whether you buy a home? Come on. This is closer to engagement farming than wisdom.

But let's steelman it anyway.

If you're trying to time the market - selling tops, buying bottoms, catching the halving pump, then yes, your belief in the cycle matters. The 4-year thesis would suggest we peaked at $126K. It felt frothy, but on-chain metrics weren't exactly screaming “blow-off top”.

Here's the thing though: if you're DCA-ing consistently, the cycle debate is mostly academic. You're not betting on timing. You're betting on Bitcoin over decades. For context: Bitcoin is up over 400% since the last halving regardless of when you bought.

The real question isn't whether the cycle is dead. It's whether your strategy survives over the long run.

Focus on the long run and get set up your own auto-stack in less than 2 mins.

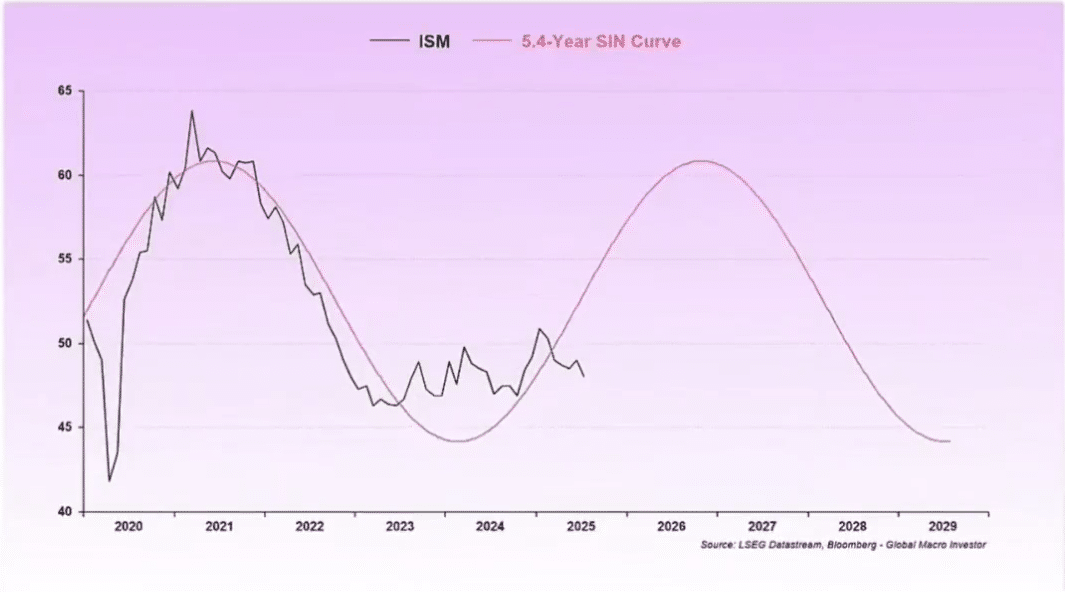

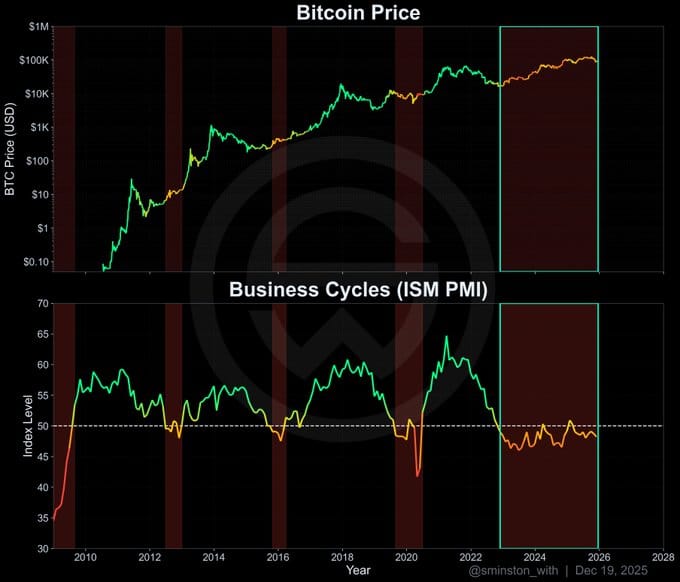

2. Forget Halvings - Watch the ISM

Remember a few months ago when every macro account was posting the Bitcoin liquidity chart? "Liquidity goes up, Bitcoin goes up”. It was macro gospel.

Turns out they were looking at the wrong chart.

Source: @sminston_with

The chart making the rounds now is the ISM Manufacturing PMI overlaid with Bitcoin price. The correlation is striking.

“Halvings don't create Bitcoin bubbles, the business cycle does. And they don't follow strict 4-year cycles”

This makes logical sense. Bitcoin sits at the far end of the risk curve. When business cycles expand, risk appetite grows and capital flows into speculative assets. When they contract, capital retreats.

This explains why tech stocks held up this year while crypto got hammered. Crypto is further out on the risk curve than even tech - more sensitive to the liquidity conditions that business cycles drive.

The liquidity chart wasn't wrong. It was just downstream of something bigger.

If this framing is correct, the question isn't "when's the next halving pump?" It's "where are we in the business cycle?" And according to that ISM chart, patience may be about to pay off for all us BTC hodlers.

Poll: What actually drives Bitcoin's price? |

3. Prediction Markets: Intelligence or Gambling Wrapper?

Google and the big players are selling prediction markets as "crowd intelligence that beats experts and polls". However, when you can bet on political outcomes, you're not forecasting - you're actually gamifying democracy.

This week I broke down why these platforms are, at their core, gambling revenues wrapped in a forecasting story.

The Final Word

The 4-year cycle might be dead. Or evolving. The ISM chart might be the key. Or it might be the next narrative that gets replaced in six months.

Narratives come and go. The liquidity chart was gospel (until it wasn't).

The halving cycle was inevitable (until it wasn't).

The point is, one can never be too certain…

The stories we tell ourselves about markets are seductive. Sometimes they're even right. But the simplest strategy doesn't require you to predict which story wins.

Narratives expire. Bitcoin doesn't 😉 .

Chat next week,

- Hector

P.S. Do you still believe in the 4-year cycle? Hit reply and tell me why or why not - best responses get 2,100 sats and a shoutout on Twitter.

How could we improve? |