- The Roundup

- Posts

- The Pressure Test

The Pressure Test

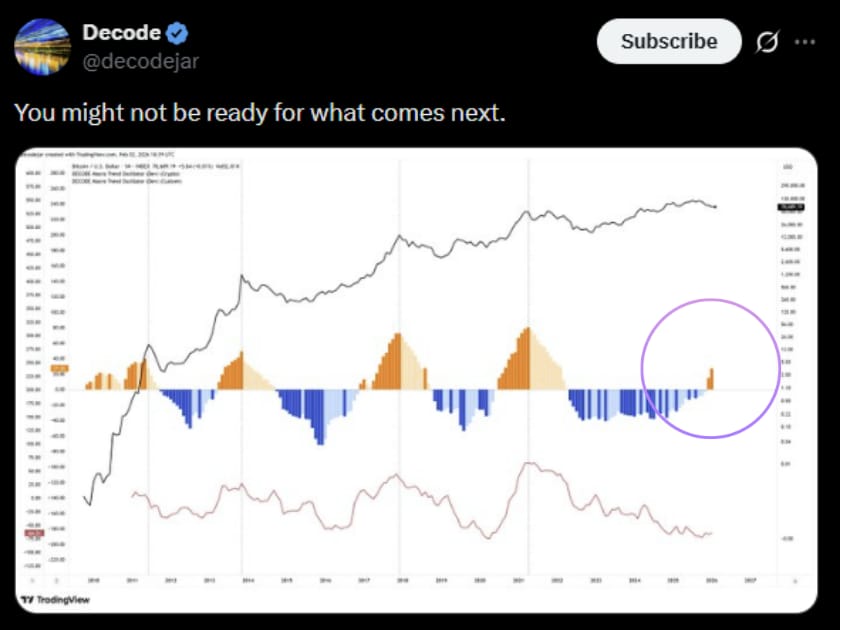

Bitcoin dropped 40% from its all-time high. The Fear & Greed Index just hit levels we haven't seen since FTX collapsed more than 3 years ago.

Happy Tuesday Bitcoiners (if you're still standing after this weekend, you're already ahead).

It's been a brutal stretch this last week. Bitcoin dropped below $74,500 for the first time since April, over $2.5 billion in positions got liquidated, and the Fear & Greed Index hit 14 (Extreme Fear.

The last time sentiment was this low? The FTX collapse in 2022.

But fear is often when the real money is made. Here's what mattered in Bitcoin this week:

A new Fed Chair nominee spooked just about every risk asset on earth

Strategy's $76k cost basis got tested for the first time in over half a decade

Why big time analysts are all calling this the bottom

🎥 Watch: ZachXBT just exposed a contractor's son who allegedly siphoned $40M+ from U.S. Marshals seized Bitcoin wallets.

If the feds can't secure their own $12B stash from insiders... 👇

1. Kevin Warsh: The New Fed Chair

Trump dropped the bomb Friday evening. Kevin Warsh, former Fed governor, known as an inflation “hawk”, and strong-dollar advocate, is his pick to replace Jerome Powell when his term ends in May.

Markets didn't wait to capitalize. Bitcoin fell more than 15% in 72 hours. Gold dropped 11% and silver crashed 31%! This wasn't a bitcoin-specific event though, but rather a broader risk-off repricing across all “hard assets”.

The concern? Warsh has historically favored tighter monetary policy, a smaller Fed balance sheet, and higher real interest rates. That's the opposite of what risk assets like Bitcoin thrive on.

But dig deeper and the picture gets more nuanced because in a 2015 interview, Warsh actually defended Bitcoin to Stan Druckenmiller. He said Bitcoin "could provide market discipline" and is "getting new life as an alternative currency".

Trump himself said Warsh "wants to lower rates" and will do so without White House pressure. And Jeff Park at Bitwise argued that a hawkish Fed "may actually strengthen the narrative for Bitcoin as a hedge against tightening”.

Markets are panicking over the new Fed Chair Warsh who said in a 2025 Hoover Institute interview that Bitcoin "does not make me nervous". History rewards those who buy when short term fear is disconnected from the long term fundamentals.

2. Strategy’s Line in the Sand

This is the one cost basis that had everyone watching.

Bitcoin's drop to ~$75,500 briefly pushed the price below Strategy's average cost basis of $76,037 per coin. For the first time in 5.5 years, Michael Saylor's entire stack of 713,502 BTC, acquired for $54.26 billion, was underwater.

At the low, unrealized losses hit roughly $900 million.

As soon as Bitcoin hit this level, media outlets started shouting "Is the dam breaking?" "Saylor's bet fails" etc. etc. (you know the hype drill).

Here's what they leave out though: all 713,502 BTC are unencumbered. None pledged as collateral. No margin calls. No forced selling. The $8.2 billion in convertible debt on the books has flexible terms and staggered maturity profiles.

Saylor's response? He posted "More Orange" on Sunday, signaling more buys were incoming.

Last week's purchase was just 855 BTC for $75 million. That's tiny by Strategy standards (they bought $2.13 billion worth just two weeks earlier). But the playbook hasn't changed. Even at breakeven, even with MSTR shares hitting a multi-year low of $138.80, the man is still buying more BTC.

For context: in 2022, Strategy traded below its Bitcoin value for most of the year. The company survived. The stock recovered. And Saylor kept stacking. We've seen this movie before.

3. January’s Verdict Is In

Let's call this week what it is: a full-blown correction to the downside.

Bitwise CIO Matt Hougan isn't sugarcoating it. In a note this week, he said this isn't a "bull market correction" or "a dip." It's a "2022-like, Leonardo-DiCaprio-in-The-Revenant-style" drawdown.

What’s noteworthy is that it didn't start in October 2025, but rather the bear market actually began in January 2025 (~ 13 months ago). ETF flows just papered over the truth for Bitcoin.

And the numbers do a good job confirming it:

$2.5 billion in liquidations over the weekend. The leverage is getting flushed.

$1.61 billion in net outflows from US spot Bitcoin ETFs in January (the longest monthly outflow streak since launch).

14/100 on the Fear & Greed Index. Extreme Fear and lowest reading on record since the FTX blowout.

So why is this good news?

Well, bear markets typically last about 13 months. We're already there. Bitcoin has now spent over 100 days in drawdown without signs of recovery. That sounds bad, and it is.

But here's what's different from 2022: the macro backdrop isn't collapsing. The Nasdaq is cooling, not breaking down. And all the while, the Fed is staying the course, instead of adding fuel to the fire.

Fundstrat's Tom Lee went on CNBC and called the bottom, predicting "parabolic upside" based on Tom DeMark's price targets. Hougan calls it stored potential energy. Ecoinometrics calls it "an uncomfortable middle ground." All agree: this isn't 2022's synchronized liquidation event.

Thirteen months of pain. The tourists are gone and the leverage is all but flushed out of the system. For those still here, the only question is - are you positioned when the turn arrives.

📊 Poll: How long does a typical Bitcoin bear market last? |

The Final Word

A new Fed Chair spooked markets, but his actual Bitcoin views are more nuanced than the sell-off suggests. Strategy went underwater for the first time, and Saylor responded by signaling more buys. January's ETF outflows were ugly, but the same fear that drove them has historically marked bottoms, not beginnings.

Every cycle has a moment where conviction gets tested. This is that moment.

Chat next week,

- Hector, COO

How could we improve? |