- The Roundup

- Posts

- The Year Bitcoin Won Everything (Except Price)

The Year Bitcoin Won Everything (Except Price)

A flat chart that hides a revolution

Good morning Bitcoiners, Hector here with our final Roundup of 2025.

Before we pop the champagne this NYE, let's first take stock.

Gold is up 66% this year.

Silver is up 130%.

Bitcoin? Flat.

But that flat chart hides what we believe to be a quiet revolution. Let's look back at what actually changed in the last year.

1. The Year Bitcoin Won

Here's what happened this year, all while the price chopped sideways:

January: Trump pardoned Ross Ulbricht on Day One. The same week, regulators repealed SAB 121 - the rule that made it nearly impossible for banks to custody Bitcoin.

March: Trump signed an executive order creating the U.S. Strategic Bitcoin Reserve. Around 200,000 BTC from seized assets. The government's official position: never sell.

July: The GENIUS Act became law - the first federal stablecoin framework in U.S. history. Banks can now issue stablecoins.

October: Bitcoin hit an all-time high above $126,000 - briefly surpassing Google to become the fifth-largest asset in the world.

November: Texas became the first U.S. state to buy Bitcoin with public funds through BlackRock's IBIT ETF. Arizona and New Hampshire passed similar laws.

Meanwhile over the last year, BlackRock's Bitcoin ETF pulled in over $25 billion in gross inflows - in a year the price went… nowhere? That's institutional conviction in a nutshell.

Want another crazy stat? 196 public companies now hold Bitcoin on their balance sheets. A year ago, that number was a fraction of this.

In 2025, Bitcoin’s price didn't move, but everything else did. Time to start stacking Bitcoin like the banks.

2. The Security Wakeup Call

Not everything in 2025 was bullish however.

In February, North Korean hackers pulled off the largest crypto heist in history - $1.5 billion stolen from the Bybit exchange in a single, coordinated cyber attack. The FBI confirmed it was the Lazarus Group, the same state-sponsored unit behind years of crypto thefts.

By year end, North Korea had stolen over $2 billion in crypto - a 51% increase from 2024. Their all-time total now sits at $6.75 billion.

The attack method was sobering. Hackers compromised a developer at Safe{Wallet}, hijacked AWS session tokens, and manipulated the user interface so Bybit employees thought they were approving a routine transaction. They weren't.

This wasn't some DeFi exploit or smart contract bug. It was social engineering at scale - and it worked against one of the largest exchanges in the world.

The lesson for us Bitcoiners? Custody matters more than ever.

"Not your keys, not your coins" isn't a meme. It's a security model.

If institutions are going to hold Bitcoin at scale, the infrastructure needs to harden, and 2025 proved both the opportunity and the vulnerability.

3. What 2026 Needs

Bitcoin's fundamentals improved dramatically in 2025, yet price didn't follow.

That gap won't last forever - but closing it requires a few things:

The business cycle needs to turn. As we discussed a few weeks ago, Bitcoin trades at the far end of the risk curve. When the ISM contracts, risk assets suffer. The macro environment in 2025 favored gold and cash. If that shifts, capital flows back into Bitcoin.

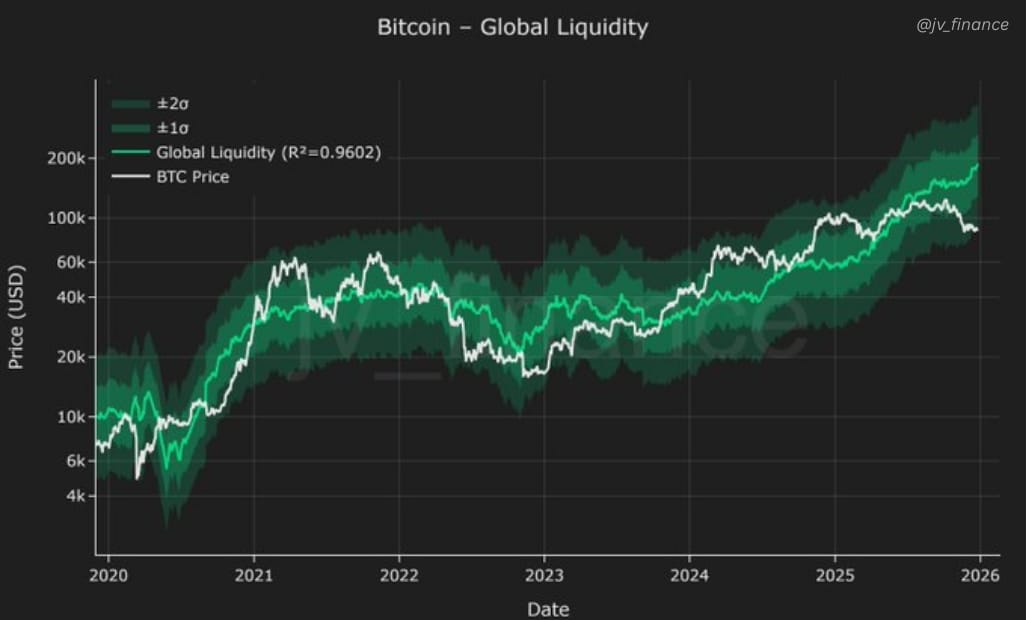

One model worth watching: the global liquidity overlay. According to analyst Julius, Bitcoin's "fair value" based on liquidity sits at $184,000 - while price hovers around $88,000. Either this model breaks, or the gap closes.

ETF inflows need to sustain. $25 billion flowed into IBIT during a flat year. If price starts moving, that number could accelerate even further, and rapidly.

The ‘DAT reckoning’ needs to complete. Over 200 companies adopted the "MicroStrategy playbook" in 2025. Most are now trading below the value of their Bitcoin. Strategy itself is down 64% from summer highs.

Remember Nakamoto Holdings from our December 17th issue? The company that borrowed $210 million and is now down 98%? One Twitter influencer had it in his portfolio back in June, alongside MSTR and MSTY.

Recently he was publicly called out and his track record questioned (see below).

The weak hands in the treasury company space need to wash out before the next leg up.

The building blocks are in place: regulatory clarity, institutional access, government reserves, state adoption. What's missing is momentum - and that tends to arrive when sentiment is at its local lows, and its least expected.

Poll: What was 2025's most important Bitcoin development? |

The Final Word

2025 was the year Bitcoin became a boring asset class - and that might be the most bullish thing that's ever happened.

The government created a reserve. Banks got permission to custody. States started buying. Institutions kept allocating through a flat market.

Gold had its year in the sun, while Bitcoin built its decade.

The price will catch up. It always does. And when it does, the people who stacked Bitcoin through the boring times will be glad they did.

Happy New Year, Bitcoiners. See you in 2026.

Chat next week,

- Hector

P.S. How would you rate Bitcoin’s performance this year out of 10? I’m always interested in hearing from other Bitcoiners - reply to this email and let me know.

How could we improve? |