- The Roundup

- Posts

- When Smart Money Buys the Fear

When Smart Money Buys the Fear

💎 Harvard doubles down while retail panics - the widening gap between institutional conviction and market sentiment

Welcome everyone to the latest edition of The Roundup!

This week on our radar, we're covering the following 👇

Long-term holders sell hard while Harvard stacks even harder

Why this consolidation isn't the bear market everyone fears

Peter Schiff's five-year track record of being spectacularly wrong

Let's begin!

1️⃣ The Great Divergence: Whales Dump, Institutions Accumulate

The on-chain data tells a clear story. Long-term Bitcoin holders recently sold ~815,000 BTC over the past 30 days - the highest distribution level since January 2024 (red bars in image below).

These are the OGs taking profits as Bitcoin defended the psychological $100,000 level.

But here's where it gets interesting…

While retail traders headed for the exits, Harvard University subtly tripled (yes, tripled) its Bitcoin ETF position to $400+ million. The institution now holds 6.8 million shares of BlackRock's IBIT representing a 2.5x increase from Q2 of this year alone.

This isn't just Harvard's largest single investment by dollar value, it's bigger than their combined holdings in Meta, Nvidia, and Alphabet.

Bloomberg ETF analyst Eric Balchunas called it "as good a validation as an ETF can get" noting that top-tier endowments almost never buy ETFs.

The divergence couldn't be clearer. Original Bitcoin holders from previous cycles are booking profits. Meanwhile, sophisticated institutional capital is entering at $90-$100K, viewing these levels as attractive for multi-decade exposure.

Then came another catalyst - the Czech National Bank became the first central bank in history to directly purchase Bitcoin. The $1 million pilot portfolio includes BTC alongside a USD stablecoin and tokenized deposit.

This marks the culmination of a 10-month journey. Back in January, CNB Governor Aleš Michl proposed investing up to 5% of the country's €140 billion reserves in Bitcoin - potentially €7 billion.

ECB President Christine Lagarde immediately shot down the idea, calling it inappropriate for central bank reserves. But Michl, whose country maintains independence from the euro, pushed forward with a scaled-down pilot instead.

"The aim was to test decentralized Bitcoin from the central bank's perspective and to evaluate its potential role in diversifying our reserves", Michl explained.

The $1 million test is small, but the precedent is massive. A Western central bank just broke ranks and bought Bitcoin despite direct ECB opposition.

2️⃣ Consolidation, Not Capitulation

The Fear & Greed Index crashed to a reading of 10/100 this week, hitting "Extreme Fear" territory not seen since late February ‘25. BTC fell below $93,000 yesterday, and now panic has swept through social media.

But the data points toward a more positive recovery arc.

History provides the roadmap. When the Fear & Greed Index drops below 20/100, Bitcoin's average forward returns show gains of 5.2% after one week, 9.3% after two weeks, and 19.9% after one month. The three-month average? A staggering 62.4%.

Readings below 20/100 have consistently signaled above-average returns. Not sometimes. Consistently.

Bernstein's latest research reinforces this view, arguing that current consolidation represents short-term profit-taking rather than a cycle peak. The firm maintains Bitcoin's structural bull market remains intact, driven by improving regulatory clarity and continued institutional flows.

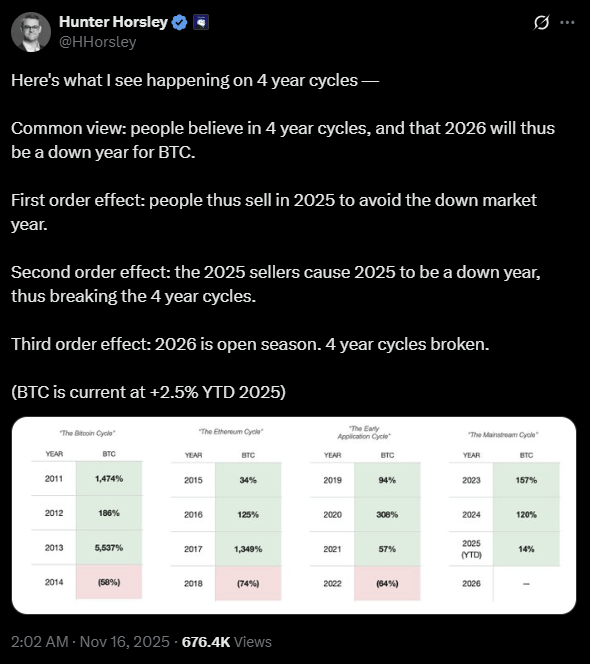

Then there's the four-year cycle thesis breaking in real-time. Hunter Horsley captured this perfectly in his tweet below 👇

Bitcoin sits at just +2.5% year-to-date after hitting $93,000. The cycle may already be broken, which means 2026 is wide open.

The setup is textbook. Widespread fear. Institutional accumulation. Historical data screaming opportunity. And Bitcoin doing exactly what it's done at every inflection point - shaking out weak hands before the next leg higher.

3️⃣ Peter Schiff's Five-Year Victory Lap (Into a Wall)

Gold bug Peter Schiff had a busy week calling Michael Saylor's MicroStrategy business model a "fraud" and doubling down on his anti-Bitcoin crusade.

There's just one problem. He's been catastrophically wrong for half a decade.

Let's revisit November 2019, when Bitcoin traded around $9,000.

Schiff declared: "It looks like the Bitcoin pump is finally over. Get ready for the dump!"

Another Twitter user predicted his response: "Peter in the future: Bitcoin dumps 25% 'I told you it would dump!' Bitcoin dropped from $100,000 to $75,000"

Schiff's reply? "Keep dreaming. Bitcoin is never going to hit $100,000!"

Bitcoin proceeded to hit $125,000 in October 2025 (a 1,289% gain from his prediction). Even at current levels around $93,000, Bitcoin is up 933% since Schiff declared the "pump was over".

So why does Peter Schiff continue fighting Bitcoin with such fervor?

Three possibilities:

Ego and public commitment - After years of predicting Bitcoin's demise, admitting error would be professionally devastating. His investor base bought gold based on his recommendations, and pivoting now would trigger a massive client exodus.

Direct competition - Bitcoin competes directly with gold's market cap as the superior store of value, threatening the core of his business model and wealth.

Cynical manipulation - He understands Bitcoin perfectly but rides its narrative coattails to maximize engagement and sell more gold to his followers.

The irony is rich. Schiff criticizes Saylor for "gambling" while Saylor's Bitcoin strategy has generated approximately $30.7 billion in unrealized gains. Meanwhile, Schiff's gold predictions have consistently underperformed Bitcoin by orders of magnitude.

Bitcoin's mathematical scarcity and digital portability make it the obvious successor to gold in a digital economy. Gold can't be programmed, instantly settled, or perfectly divided. Bitcoin can.

Peter Schiff will likely never acknowledge this reality. But the market already has.

Why do you think Peter Schiff fails to understand Bitcoin? |

🎯 The Final Word

Harvard tripled its Bitcoin position while Fear & Greed hit decade lows. The Czech National Bank became the first central bank to buy Bitcoin directly. And Peter Schiff's five-year track record proves gold bugs make the best contrarian indicators.

The divergence between long-term holder distribution and institutional accumulation reveals the generational wealth transfer happening in real-time.

Original Bitcoiners are taking profits at $100,000. Sophisticated capital is deploying at the same levels, viewing Bitcoin through a multi-decade lens rather than quarterly performance windows.

The money printer also isn't stopping any time soon, and institutional capital isn't slowing down its bid to buy up Bitcoin.

The only question isn't whether the system will keep debasing. It's whether you'll follow Harvard's playbook and buy the fear, or panic-sell to institutions at $90k-$100k.

Chat next week,

The Rhino Bitcoin Team

P.S. Harvard didn't triple its BTC position because they think it might work out. They did so because they've done the math on Bitcoin - and it checks out!

So copy Harvard and start your Bitcoin journey today with industry-low fees on Rhino available here (for iOS) or here (for Android).

⚡Lightning Round

Japan Announces $110 Billion Stimulus Package: Finance Minister confirms massive economic stimulus, potentially signaling liquidity expansion favorable for risk assets.

Bitcoin CME Gap at $92K Approaches: Technical analysts watching closely as Bitcoin price action nears unfilled CME futures gap at $92,000.

World's First Bitcoin Master's Program Launches: Hesperides University introduces comprehensive Bitcoin-focused Master's degree, marking institutional education milestone.